Essential medical supplies are in high demand in today’s current environment, including surgical gloves. One way to fulfill this demand is to import gloves from foreign countries. When importing medical devices of any kind, including something as simple as gloves, you’ll still need to consider government regulations, customs clearance, tariffs, and more.

Key Takeaways

- Importing nitrile gloves for medical purposes involves following various regulations set by the Food and Drug Administration (FDA) such as getting a 510(k) premarket notification and avoiding the import of powdered gloves.

- Duty rates vary from zero to 14% depending on product details and country of origin.

- Most surgical gloves are covered in chapter 40 of the Harmonized Tariff Schedule (HTS).

- In May 2024, The Biden Administration announced an increase in tariffs on medical gloves from China, from 7.5% to 25%, which will take effect in 2026.

Join us as we review the information you need to successfully import surgical gloves into the United States.

What is the Import Duty for Nitrile Gloves?

Depending on product details and the country of origin, duty rates on nitrile gloves imported into the U.S. range from zero to 14% of the shipment’s total value. It’s important to use the correct HTS code when you import these goods. Otherwise, you risk being fined by CBP due to product misclassification incorrect import duties.

Nitrile gloves are part of a larger group of medical gloves that includes examination gloves and special chemotherapy gloves designed specifically for handling chemotherapy products. These are considered personal protective equipment, according to the U.S. Food and Drug Administration (FDA).

They aid healthcare workers and patients by protecting their hands from infectious germs or harmful substances.

Top Countries for Importing Surgical Gloves

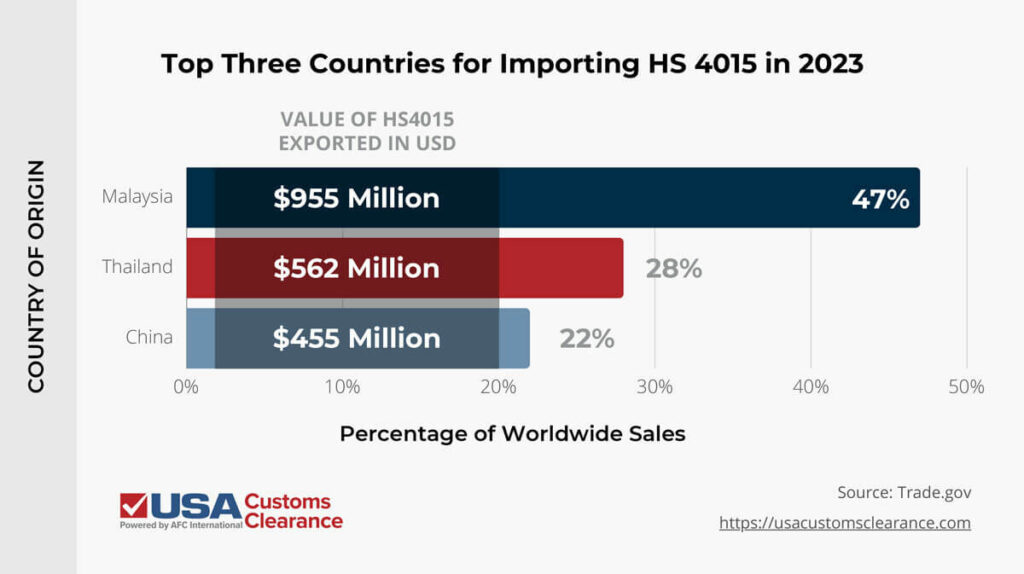

Single-use gloves such as those used in the medical field are mostly classified under Harmonized System code 4015 — articles of apparel & access of unhardened rubber. According to data from trade.gov, this code accounted for approximately $2.2 billion worth of goods imported to the USA in 2023, with the following three countries taking up the lion’s share of that business.

While China once dominated this market, changes to trade policies have made sourcing Chinese goods less appealing for importers in the United States.

Tariffs on Goods From China

In 2018, the U.S. government began applying additional tariffs on nearly all goods imported from China. These new restrictions significantly impacted trade between the two world powers.

In May 2024, the Biden Administration announced a new set of tariffs on medical glove imports from China, increasing the rate of duty from 7.5% to 25%, starting in 2026.

FDA Guidelines When Importing Nitrile Gloves

Surgical gloves are grouped together with other types of medical gloves by the FDA. These items range in design from basic gloves used for general examinations to specialized versions used to handle hazardous materials.

They’re further classified as personal protective equipment (PPE). This large classification encompasses a variety of products that are meant to prevent the spread of infection, illness, and injury.

Other examples of PPE include:

- Facemasks

- Safety helmets

- Protective clothing such as lab aprons and hazmat suits

- Goggles

If your goods meet FDA standards, you can initiate the import process. Many importers choose to speak with an import consultant at this point. Working with a consultant reduces the likelihood that difficulties will arise during customs clearance. This includes complete loss of goods due to seizure by CBP, which many importers experienced during the pandemic in 2020.

If you’re unsure about the import compliance of your shipment, we recommend working with one of our experienced customs brokers to avoid delays, fines, and penalties.

Do I Need to File a 510K Notice?

Gloves intended for medical use, including surgery, are categorized as class one medical devices. The FDA reviews these goods to ensure that they meet specific criteria related to safety and performance. Their regulations may require you to file a 510(k) premarket notification prior to bringing such goods into the U.S.

For gloves that have already been approved by the FDA, you’ll simply need to reference the existing approval rather than filing a new one. If items have been significantly modified since their initial approval, you will probably need to submit a new 510k form for the agency to review.

Are Powdered Gloves Banned in the USA?

In 2017, the FDA banned the use of powder as a lubricant in single-use medical gloves, including those used for patient examinations and surgical applications. This ban applies to disposable gloves of all materials and extends to veterinary use.

The ban is limited to clinical purposes, so powdered gloves can still be used in lab research, janitorial tasks, food preparation, and other situations that don’t involved contact with a patient. However, they still have the potential to cause swelling and inflammation to the wearer after extended use.

If you plan on importing these goods for medical use in the USA, it’s important to make sure they’re not of the powdered variety.

Do I Need a Customs Bond?

One of the most important aspects of the import process is ensuring you have a customs bond when necessary. A bond is required when importing $2,500 or more worth of goods. This is also required when the goods in question are regulated by government agencies. Therefore, you’ll need a bond to import gloves for medical use.

USA Customs Clearance offers continuous customs bonds, which cover all import transactions within one year of the bond’s issue date. With same day approval for a customs bond, we can get your import moving quickly and into the hands of your customers.

Importing Surgical Gloves With USA Customs Clearance

Trying to import surgical gloves in the current state of the supply chain can be a daunting task. Luckily, you don’t have to go it alone.

USA Customs Clearance is here to help guide you through the process. From gathering and completing all the required paperwork to clearing your goods at the border, we’ll be with you every step of the way.

Our suite of customs clearance services includes:

Schedule your customs consulting session with USA Customs Clearance today by calling us at (855) 912-0406 or contacting us online. Our knowledgeable and experienced consultants are ready to assist you with all of your importing needs.