Despite shaky relations between the nations, China is still a popular trade partner for U.S. businesses. It isn’t easy to find new sources for over half a trillion dollars worth of goods, after all, so importers still need to have a strong grasp on the requirements of importing from China.

Key Takeaways:

- Section 301 tariffs have been enacted on many Chinese commodities in order to prevent dumping and other unfair business practices.

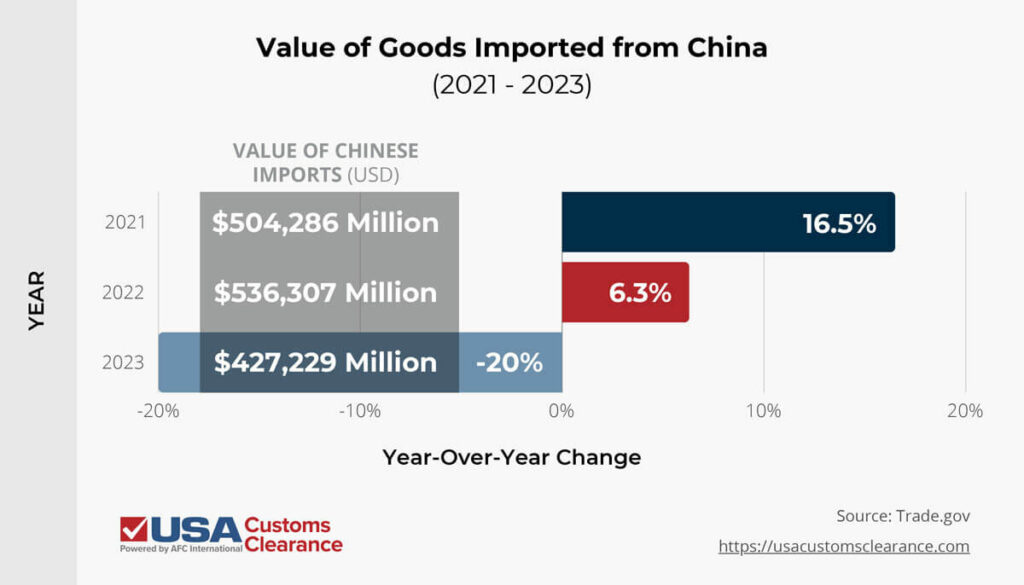

- The U.S. spent 20% less on Chinese imports in 2023 than it did in 2022.

- Despite these issues, China is still a leading source of machine parts and electrical components.

Understanding the basic concepts associated with importing from China can help make the import process hassle-free. We’ll show you those basics and how to find out if your Chinese goods are subject to additional tariffs.

Basics on Importing Goods From China

In the years since the COVID-19 pandemic, global health concerns have seriously impacted trade with China, creating a burden for many seeking to import goods. However, Chinese goods are still trickling into the U.S. and there are still opportunities for importers.

Some of the most in-demand goods come from China. Many international merchants seek to import everything from medical equipment to furniture and more.

To keep trade flowing from China to the U.S., some tariffs and regulations have been lifted. Items you can import from China that are exempt from tariffs include:

- X-ray machine parts

- Animal feeding machinery

- Small electric motors

- Air purification equipment

Of course, that list represents only a fraction of possible imports. Since there are still goods exempt from tariffs, many importers are continuing to seize the opportunity to expand their business. However, unfair trade practices on China’s part have prompted the U.S. government to dissuade importing certain goods from the Asian economic powerhouse.

Understanding the China Section 301 Tariffs

In 2018, the Trump administration issued a series of high tariffs on Chinese goods entering the United States. Known as Section 301 tariffs, they were meant to reduce the trade deficit between the two nations, encourage U.S. domestic manufacturing, and incentivize the Chinese government to respect intellectual property rights.

Ultimately, these tariffs have had a massive impact on the import value of products from China to the U.S. This is illustrated in the table below with information sourced from trade.gov.

After years of consistent growth, China lost its position as the number one exporter to the U.S. in 2023, being supplanted by Mexico. This is largely the result of Section 301 tariffs at work. While there’s still some value in importing certain Chinese goods, it’s never been more important for importers to understand the present and future of these tariffs.

Over time, the Office of the United States Trade Representative (USTR) released four lists of goods that would be subject to higher tariffs until further notice, encompassing almost every item that can be imported. The tariff rates applied to many of those goods will continue to increase, all the way up to 100% by 2026 in some cases.

On the bright side, the U.S. has published several lists of goods that were excluded from those tariffs, which can be seen in these section 301 tariff exclusions. Importers that brought in excluded goods can file for a retroactive drawback claim to get refunded for the taxes they may have already paid on the import.

For more information, make sure you check out our article on the topic: Section 301 Tariffs: A Comprehensive Guide.

How to Import Wholesale Products From China to the U.S.

Many importers travel to China to meet with suppliers while building a wholesale business. Several regions in China specialize in the manufacturing and wholesale of specific goods, such as furniture and toys. China also has unique seasons when manufacturing and importing/exporting are in flux, like Chinese New Year.

If you are unable to travel, you might want to work with a sourcing agent. They can reach out to suppliers on your behalf. Online global sourcing is also a growing market for those importing from China. Websites like Alibaba.com make it simple to order goods from Chinese suppliers.

Related: 18 Alibaba Alternatives for Product Sourcing

Be aware of minimum order quantities (MOQ) when importing from China. Generally speaking, the less expensive an item is, the higher its MOQ will be to ensure profitable sales for manufacturers and wholesalers.

After you have found the items you’d like to import, it’s time to start the process of getting your goods across the border and through customs. This involves significant legwork and planning.

To help, USA Customs Clearance offers consulting sessions to get you in the know about what it takes to import goods from China.

Related: How to Import Generators From China

Costs for Importing from China

Even though imported goods can be less expensive than domestic goods, there are some additional costs associated with bringing in goods from China. Importing costs you need to know about include:

- Transportation Costs: It’s up to you or the seller (depending on Incoterms® used) to move your goods from China to the U.S. by sea or air.

- Warehouse, Inspection, and Port of Entry Fees: Products imported from China are subject to inspection when crossing U.S. borders. In some cases, these inspections can cost you.

- Customs Broker Fees: If you work with a Licensed Customs Broker, plan on paying these fees. Brokers can help ensure all fees are paid, permits are obtained, and your goods are quickly cleared through customs.

- Import Duties:Duties on most products are assessed based on a percentage of their overall value or volume.

If you need help calculating the costs of importing specific goods from China, our licensed brokers can make sense of all the different factors that influence HTS classification, and can assist you in filling out all the right paperwork too.

Do I Need a Permit to Import from China?

There is no general import permit to bring in products from China. However, certain goods do require a special permit or license prior to importing. Different federal agencies oversee different imported products, and requirements can vary. Agencies that oversee common imports include:

- Food and Drug Administration (FDA): Oversees the import of all food, medication, cosmetics, some housewares and food-related items, health devices, and more. They require prior notice be given for all imported food products.

- Environmental Protection Agency (EPA): Regulates chemicals and other goods that could potentially harm the environment.

- Department of Transportation (DOT): This department sets regulations for importing cars and motor vehicles.

- Consumer Product Safety Commission (CPSC): Toys and children’s products are among imports regulated by this commission.

- Federal Trade Commission (FTC): Oversees a variety of parts of the import process, including product labeling and more.

- United States Department of Agriculture (USDA): Oversees the import of plants, plant-products, wood, animals and more. In many cases, the USDA requires permits and more.

- Alcohol and Tobacco Trade and Tax Bureau (TTB): Issues permits for importers of alcohol and tobacco products. TTB permits include the Federal Basic Permit, Certification of Label Approval (COLA), Natural Wine Certificate, and Certification of Age and Origin.

There are several Partner Government Agencies (PGAs) that importers need to be aware of in order to stay compliant. A customs broker can help you understand all the requirements that apply to your shipment, and can get in touch with all the applicable PGAs on your behalf.

Related: Importing Glass From China

What Are My Responsibilities to the U.S. Government?

Your main responsibility to the government during an import transaction is the payment of all relevant duties, tariffs, and taxes. The Harmonized Tariff Schedule (HTS) lists product codes, which are used to determine the duty percentage, ensuring a level playing field in the business sectors.

For help classifying your imports, you can work with an experienced customs broker. Most brokers have imported goods into the U.S. hundreds—if not thousands—of times. They know the process inside and out, and you can count on them to answer any of your questions about tariff classification and importing in general.

As CBP expands its efforts to enforce the Uyghur Forced Labor Prevention Act, it’s also increasingly vital for importers to trace the supply chain of any goods they purchase. Several large businesses have already received pre-audit notifications for upcoming CBP inspections based on suspicion of components as simple as silicon being sourced from the autonomous region.

Even if your supplier isn’t 100% forthcoming about the country of origin for its goods, it’s your responsibility to avoid bringing these goods into the United States. That means you’ll face any potential consequences for violation of the UFLPA.

If you plan on importing anything from China or a Chinese trade partner, check out our article: What Importers Need to Know About the Xinjiang Import Ban.

Do I Need a Customs Bond?

CBP mandates that you use a customs bond when your imports are valued at more than $2,500 or the imports are subject to another federal agency’s oversight. Generally speaking, if you’re importing goods for resale, you will need a bond on file with CBP.

Related: How to Get a Customs Bond

China Import Consulting With a Licensed Customs Broker

A Licensed Customs Broker can be a great asset to you when importing from China. They will make sure that your imported goods cross borders efficiently and arrive at the port of entry in a timely manner. In addition to that, they can help you ensure that your shipment follows all customs regulations and rules when entering the country.

Your Broker can provide a variety of services when importing from China: These might include:

- Arrange customs clearance for imported goods at the port of entry.

- Prepare for the release of goods

- Work with CBP to ensure that all government duties, taxes, and fees are paid as needed.

- Determine which permits are required to import your goods and help you with obtaining the needed permits.

- Advise you through the import process, including determining entry options for your goods, navigating free-trade agreements, and tax or duty deferment.

Our Brokers can go over all the necessary details for your shipment and ensure it’s compliant with CBP and other regulations.

Get Help Importing From China With USA Customs Clearance

Importing from China can be a lucrative, exciting and, at times, challenging endeavor. Allow USA Customs Clearance to help manage challenging times while you enjoy the lucrative ones.

Working with our customs specialists can help ensure that you have all the proper documents in place, making your import transaction seamless and easy.

Our comprehensive suite of importing services includes:

- Customized consulting sessions

- Secure customs bonds

- New importer success bundles

Give us a call at (855) 912-0406 or contact us online to get in touch with a customs specialist who can get you the information you need right now.