The U.S. produced approximately 140 million pounds in 2023. As big as that number seems, Americans consume triple that amount or more in an average year. That means more than 400 million pounds of honey need to be imported annually to satisfy the American population’s demand for this popular sweetener.

Key Takeaways

Importing honey to the U.S. requires adhering to FDA and USDA regulations, which include strict labeling requirements. However, if your honey import is coming from China, it will be subject to severe anti dumping/countervailing duties (AD/CVD).

No other country in the world imports as much honey as the USA. In this article, we show you how to take advantage of the country’s insatiable demand for the sweet stuff while remaining compliant with all relevant regulations.

Top Honey-Exporting Countries

Given the demand for honey in the U.S., those looking to import this natural sweetener would do well to build trade relationships with growers in multiple countries.

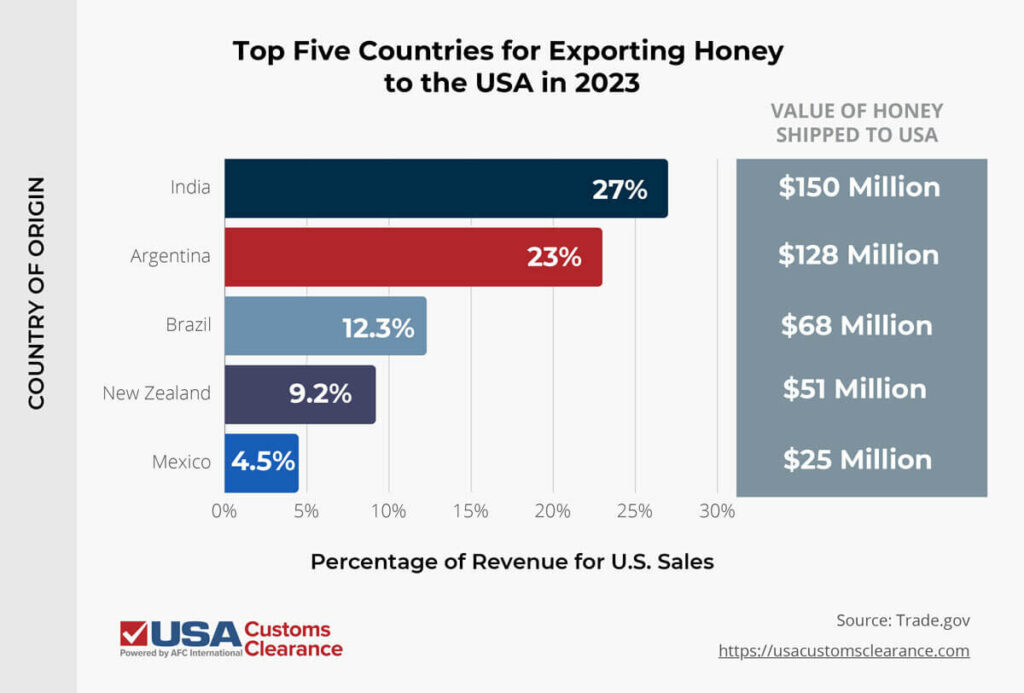

The USA imported approximately $553 billion worth of honey in 2023. In the following table, I’ve listed the top five countries who supplied it to stateside importers.

As of this writing, the following countries are subject to AD/CVD on imported honey.

- India

- China

- Argentina

- Brazil

- India

- Vietnam

No matter which country or countries you choose, one of your first responsibilities as an importer is to make sure your honey meets regulations for sale and consumption in the U.S.

Regulations for Importing Honey to USA

Before you can get in on this multi-million dollar a year industry, you’ll need to understand the laws and regulations for importing honey in the first place. The Food and Drug Administration (FDA) is the federal government agency in charge of regulating imports of food products into the United States, including honey.

- Firstly, any facility that is involved with the harvest, creation, storage, packing, or transportation of imported honey must be registered with the FDA before you send your shipment to the border. If your supplier isn’t already registered, they should start the process to do so immediately. Otherwise, your shipment will be denied entry.

- Once that is done, you’ll need to make sure your supplier has a Hazard Analysis and Critical Control Point (HACCP) plan in place. This is used to identify, monitor, and prevent hazards within the facility, ensuring food safety.

- Finally, you will need to alert the FDA of when your shipment will be reaching its port of entry. This prior notice requirement is important for making sure your shipment is inspected and handled quickly, so it doesn’t spoil.

Honey intended for human consumption isn’t subject to regulation beyond the general guidelines above and labeling requirements, which we’ll discuss below. However, if you import it as feed for bees, there are more steps involved.

- The exporting government must provide a certificate stating the honey was heated to 100°C (212°F) for no less than 30 minutes.

- You’ll need to contact the USDA’s Plant Protection Quarantine program to secure a special importing permit.

Looking to import bees or beeswax? You’ll have some additional requirements you’ll need to meet. Check out our article Importing Bees and Beeswax to the U.S. for more information.

Labeling Requirements

The United States Department of Agriculture (USDA) requires the following information on honey labels to pass import inspection:

- A grade, sampling or continuous inspection mark

- Words that are legible and in English

- The words “Product of,” followed by the country of origin

The FDA also requires the following on all food labels:

- The common name of the product (“Honey” in this case, unless it’s diluted)

- The net weight of the package

- The ingredients (if the honey is not pure)

- The contact information of the shipper, manufacturer, farmer, packager, or distributor

Sometimes, producers will dilute their product with colorants or additional sweeteners, then try to sell it like pure honey. They can stretch their honey supply and make more money this way, but it’s illegal to advertise this as “pure” or “100%” honey.

This practice is known as “honey laundering”.

Failing to report all the ingredients in a package of food can have serious consequences, and you can be sure your import won’t get through customs.

It is your responsibility to ensure that your supplier’s labels are true and accurate, and that the honey you’re importing is pure. Failure to label your honey shipments properly will result in their seizure and destruction. You may even face legal repercussions.

Importing Honey From China

Be wary of importing honey to the U.S. that comes from China. In 1997, deadly bacteria infected hives all across China and threatened to destroy the honey industry in the entire country. Chinese beekeepers treated their hives with the antibiotic Chloramphenicol to kill the infection. It worked, but there was one problem: that antibiotic is toxic to humans.

Chloramphenicol is banned for oral consumption in the U.S. and many other parts of the world. Traces of it can still be found in honey from China. Since there is no amount of the drug that is considered safe by the FDA, even the slightest residue can cause a batch of honey to be rejected.

So, just don’t buy honey from China, right? Unfortunately, this isn’t enough to protect you from the problem. It is believed China often ships honey to other countries, where it is then imported into the United States under a different country of origin.

Always make sure to verify the source of your honey before you try to bring it into the U.S., so there are no surprises at the port of entry.

Clearing Customs with Honey Imports

Even after you’ve dealt with the FDA and USDA requirements, you still have to contend with Customs and Border Protection regulations (CBP). They protect the U.S. border from illicit materials and dangerous substances.

To get your honey safely through customs, you will need to submit:

- A packing list

- A commercial invoice

- A Bill of Lading (BOL)

- An arrival notice

You’ll also need a customs bond, unless you’re importing through a broker using their own. Bonds are usually only required on shipments valued at $2,500 or more. However, you’ll need one regardless of overall shipment value, since honey is regulated by the FDA.

Get Customs Help for Importing Honey to USA

Like any other foodstuff, honey requires importers to follow stringent regulations, which ensure the safety of American consumers. If you’re unsure whether your shipment will meet those regulations, we can help.

At USA Customs Clearance, we can assist you with importing honey to the United States. We offer secure customs bonds for your shipments and can guide you through the oftentimes complicated process of importing.

In addition to bonds, we offer a suite of services for importers, including:

- One-on-one consulting services

- Manifest confidentiality registration

- New importer success bundles

- And more

‘Bee’ prepared for any potential pitfalls in importing honey. Give us a call at (855) 912-0406, or contact us online to get in touch with a U.S. customs expert today!