Americans use millions of gallons of olive oil per year, and the perceived superiority of olive oil sourced from European countries creates ripe opportunities for importers. Boutique olive oil shops have become commonplace in malls and shopping centers throughout the country. If you’re thinking of importing this popular foodstuff, you’ll need to be familiar with rules and guidelines from certain government agencies.

Key Takeaways

- Importers of olive oil must adhere to regulations from the Food and Drug Administration (FDA) and Customs and Border Protection (CBP).

- Olive oil imported to the U.S. must be sourced from a registered, FDA-certified supplier.

- Spain and Italy are the two primary exporters of olive oil to the United States.

- General duties on olive oil range from 3.4¢ to 5¢ per kilogram.

In this article, we’ll show you what it takes to get imported olive oil to the tables of U.S. consumers.

Rules and Requirements

When considered a foodstuff or an edible cooking oil, shipments of olive oil must comply with FDA regulations. These regulations are in place to ensure the health and safety of U.S. consumers.

The FDA requires shipments of olive oil to have the following information documented.

- Proof of food facility registration

- Country of origin

- Prior notice of imported food

- Proof of participation in the Foreign Supplier Verification Program (FSVP)

Shippers must also follow general import regulations from CBP, such as ISF filings for shipments brought in via cargo ship.

Imported olive oil must meet the same standards as that which is grown or manufactured here in the U.S. Additionally, since olive oil falls into a regulated category, all shipments must be covered by a customs bond regardless of their value.

Importers can participate in the Voluntary Qualified Importer Program (VQIP) through the FDA to ensure expedited inspection to clear customs. While the program is voluntary and fee-based, eligible shippers are able to get imported goods through the process more quickly than they would otherwise.

If any of the requirements are overlooked throughout the process, the shipment could be significantly delayed for delivery, re-exported, or destroyed.

Related: The Complete Guide to FDA Customs Clearance

Import Duty On Olive Oil

Duties on olive oil vary based on factors such as its quality (virgin or extra virgin), how it’s been processed, and whether it’s a certified organic product. Most types of olive oil are subject to a 3.4¢ to 5¢ per kilogram general rate of duty, with oil unfit for human consumption having no duty at all.

These duty rates can fluctuate based on the product’s country of origin. The United States has free trade agreements in place with several countries, and olive oil imported from these trade partners will not incur duties. Unfortunately, none of these countries are top exporters of this particular commodity.

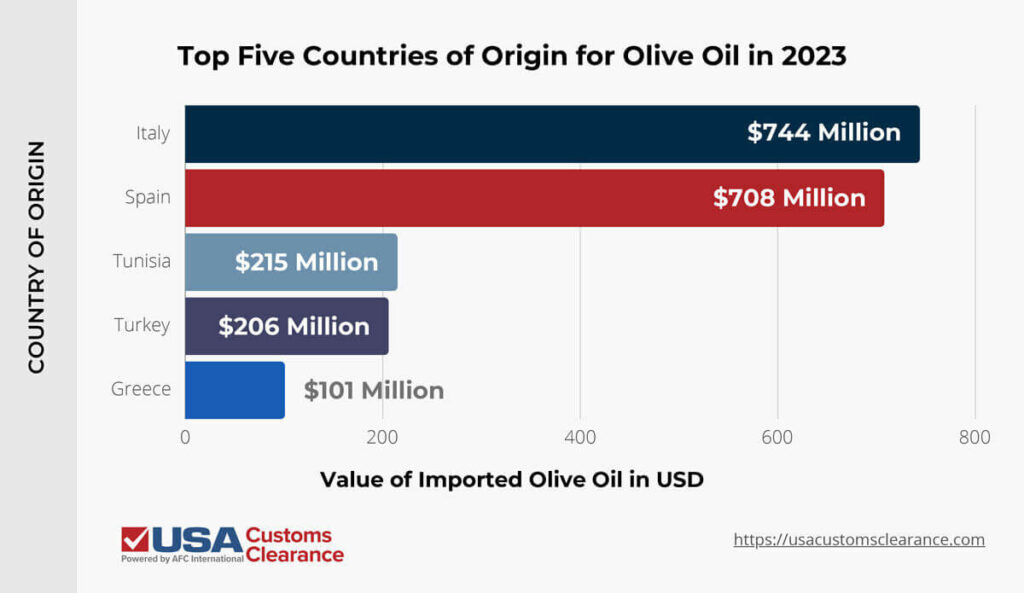

In 2023, importers brought over two billion dollars worth of olive oil into the United States, with the following countries getting the lion’s share of the business.

As you can see, Italy and Spain are major exporters of olive oil, which makes them worth some further discussion.

Importing Olive Oil from Spain and Italy

Italy and Spain currently rank as the world’s top producers of olive oil. Their locations in the Mediterranean create ideal conditions for growing many varieties of olives, which in turn provide various grades of olive oil.

If you’ve looked into importing olive oil from Spain, you may have seen information about olive oil tariffs imposed by the U.S. due to the Boeing Airbus trade dispute. While these tariffs hampered Spain’s olive oil export business in 2020, they were suspended in 2021 and are not currently in effect.

Naturally, this is good news for importers, but the situation does illustrate how quickly tariffs can be applied and repealed. Working with an experienced customs broker is a smart way to ensure your imported goods won’t be subject to these additional costs.

Get Help Importing Olive Oil into the U.S.

The hurdles of importing olive oil in the U.S. can test the resolve of an importer if going it alone. However, working with one of our licensed customs brokers can help you avoid costly mistakes.

We have years of experience helping importers like you bring shipments into the country while complying with all relevant regulations. With our assistance, you can focus on other business needs while we take care of the complexities of customs clearance.

Our list of services for importers includes:

Take advantage of our robust range of customs services by calling us at (855) 912-0406 or submitting a contact form online. We can help you make importing olive oil a smooth process.