Saffron is one of the most sought after spices in the world. Importing this product into the U.S. isn’t the most difficult endeavor to undertake, but there are still many factors to consider.

Key takeaways:

- You’ll need to follow the Food and Drug Administration’s (FDA) food importing guidelines when bringing saffron into the United States.

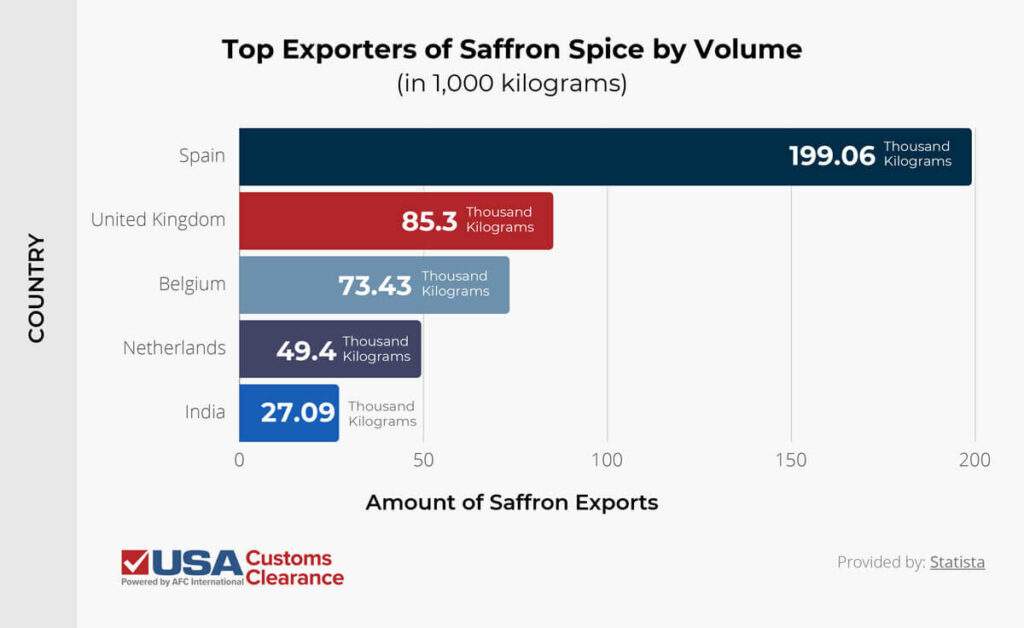

- The best countries to import saffron from include Spain, the United Kingdom, Belgium, Netherlands, and India.

- Importers need to pay various costs, such as container transport, customs bonds, port charges, and inland transportation.

Our article below provides you with the essential information you need to successfully and legally import saffron into the U.S.

FDA Regulations and Requirements

The FDA defines saffron as the dried stigma of the Crocus Sativus L., which is a perennial plant of the iris family Iradaceae. As a spice that is in high demand, there are many regulations and requirements regarding saffron. These requirements can be very intensive in some cases. In fact, one difficulty the market faces is the inundation of fake saffron.

The high cost and high demand of saffron makes it a target for less than savory companies trying to make a quick buck. The reason for this is that saffron is not only in high demand, it is also very difficult to harvest. Because of the chance of counterfeit saffron, the FDA is strict in ensuring that consumers are receiving a quality and safe product.

Additionally, when importing saffron to the United States, there are certain actions the FDA requires importers to complete. Spices like saffron qualify as a food product, which means the FDA’s food import regulations will apply to your goods.

There are four primary steps you’ll need to follow:

- Register your foreign supplier

- Submit a prior notice

- Conduct foreign supplier verification

- Label your product

We’ll walk you through what is required for each of these steps.

1. Register Facility

First, you’ll need to register processing and storage facilities in their country of origin. Any location that manufactures, processes, packs, receives, or holds your saffron must be registered with the FDA.

The following information is required when registering a facility:

- Name, address, and telephone number of the foreign facility

- Name, address, and telephone number of the facilities owner

- Trade names

- Name, address, and telephone number of the U.S. agent

- Activity carried out at the facility (storage, labeling, packing, etc.)

- Food product category

The FDA verifies your facility by comparing the submitted information with their internal data.

2. Prior Notice

The second requirement the FDA will want you to complete is to submit a prior notice for your saffron.

There are two ways to submit prior notice of imported goods. First, you can do it through the CBP’s Automated Broker Interface of the Automated Commercial Environment or through the FDA’s Prior Notice System Interface (PNSI). Both systems are online and easy to access.

Below are examples of information required when submitting prior notice:

- Name and address of both shipper and importer

- Identity of product, quantity, and lot number

- Country of production and shipment

- Shipment information such as carrier, arrival time, and more.

The FDA uses prior notice of imported food to determine if the food that will enter the country poses a threat to public health.

3. FSVP

Your next step is to complete the Foreign Supplier Verification Program (FSVP). During this part of the importation process, you’ll provide the FDA with evidence that proves your foreign supplier of saffron has put preventive measures in place to ensure your goods are safe.

You can provide this evidence by doing the following:

- Determining the known or foreseeable hazards of your saffron

- Evaluating the risk posed by your saffron based on the hazard analysis and foreign supplier’s performance

- Using the risk evaluation to approve suppliers and determine the appropriate verification process

- Conducting supplier verification and corrective actions

You’ll need to follow these steps to ensure the seller of your saffron is reliable and can provide quality spice.

4. Labeling

When bringing saffron into the U.S., the product must be properly labeled. Labeling requirements for spices including saffron are described in CFR 101.22.

All information included must be informative and truthful. Labels should either be in English or the predominant language of the U.S. territory that will receive it.

Information that should be on the label includes:

- Name and address of the foreign manufacturer

- City or town

- Country name

- Mailing code

The nutrition label and all the vital information included on it must also appear on your saffron. To speed up the clearance process of your goods, you can submit Affirmation of Compliance (A of C) codes. Using the codes essentially affirms that your saffron abides by the FDA’s requirements.

Related: Importing Organic Food Into the USA

How Much Does It Cost to Import Saffron?

Giving a precise amount on how much it costs to import saffron is difficult, but I’ll show you some expenses you’ll need to pay. In some cases, you’ll be able to circumvent certain expenses altogether.

For example, you won’t have to pay the duty rate for your saffron. The general rate for spices is completely free. Therefore, you won’t need to worry about paying this fee when your goods arrive in the country.

Costs you will have to pay include:

- Full container load (FCL) or less than container load (LCL)

- Air transport

- Customs bond

- Port charges

- Insurance

- Inland transportation

If you’re importing enough spice to fill an entire container, chances are you’ll need to pay between $2,000 and $3,000 to secure FCL transport. The cost of LCL is harder to estimate. How much you pay for this service will vary based on how many people are sharing the container with you.

You do have the option to bring your saffron into the country by plane. When using this option, you can expect a rate that charges you between $2.50 and $7 per kilogram of cargo.

Saffron that has a value of $2,500 will need to be accompanied by a custom bond. This document will usually be 10% of the total bond amount.

You’ll also have to factor in port charges for your shipment. This includes the cost to load your saffron at the port of origin and the cost to unload it when it arrives.

While international air and ocean freight transport are generally considered safe ways to move your cargo, it’s always a good idea to ensure your cargo is protected from any perils.

Therefore, you should consider getting insurance on your import. Obtaining this level of coverage will likely require you to pay a premium that’s a certain percentage of the total value of your goods.

Finally, you’ll need to arrange for inland transportation to move your spice out of the port. Your options are to use rail or truck. Rail is cheaper for longer distances, but a truck is a good option if you need to move your saffron only a short distance.

These costs might seem overwhelming for one person to pay. Before purchasing your saffron from a foreign supplier, take a look at the 11 types of Incoterms®. Based on the terms you and your supplier decide to use, you might be able to split the cost to import your spice with your foreign supplier.

What Countries Can You Import Saffron From?

There are numerous countries that produce and export saffron in extremely large amounts. With so many options to choose from, it’ll be much easier to access this product. I’ve given some data on the top saffron exporting countries that will make for great places to source saffron.

While the U.S. doesn’t share a free trade agreement with any of these nations, it does have good trade relations with each one. Therefore, you’re bound to find a supplier that will provide you with the saffron spice you desire.

Related: U.S. Free Trade Agreements

What Modes of Transport Can I Use To Move My Saffron?

The two primary modes of transport you can use to get your Saffron into the U.S. is by plane or ocean vessel.

When transporting saffron by ocean, there are several requirements necessary. First, you must ensure that you have completed the Importer Security Filing at least 24 hours before the shipment is loaded onto the vessel.

This can be completed online by providing information, such as:

- The seller’s name

- Buyer’s name

- Country of origin

You should always consider the costs when selecting your transportation method. Shipping by ocean is almost always cheaper than by air.

However, there are many advantages to shipping by plan that you may want to consider. For example, if you have a tight timeline that you’re working with, air freight may be the better decision as it’s faster than ocean transportation.

Additionally, airlines are usually on top of their schedules so even when there is bad weather they will be more reliable than sea vessels.

Import Saffron to the U.S. With USA Customs Clearance

Importing Saffron to the U.S. can be an easy endeavor when you have USA Customs Clearance by your side. Our team is staffed with Licensed Customs Brokers and importing professionals with the knowledge you need to have a successful importing experience. We have a variety of services that you can use when importing saffron.

- Import/Customs Consulting: A consulting session will give the opportunity to discuss your saffron import with one of our Licensed Customs Brokers.

- Importer Record of Registration: If you’ve never imported before, you can use our document to get registered with CBP.

- Manifest Confidentiality: This document will protect 26 different data points about your supply chain from the eyes of your competitors.

Use one of our services to help you bring your saffron into the country. You can also contact us through the site or call our team at (855) 912-0406 if you have any questions you’d like to ask.